The Equity Risk Premium (ERP) is a key input used to calculate the cost of capital within the context of the Capital Asset Pricing Model (“CAPM”) and other models. Kroll regularly reviews fluctuations in global economic and financial market conditions that warrant a periodic reassessment of the ERP and the accompanying risk-free rate.

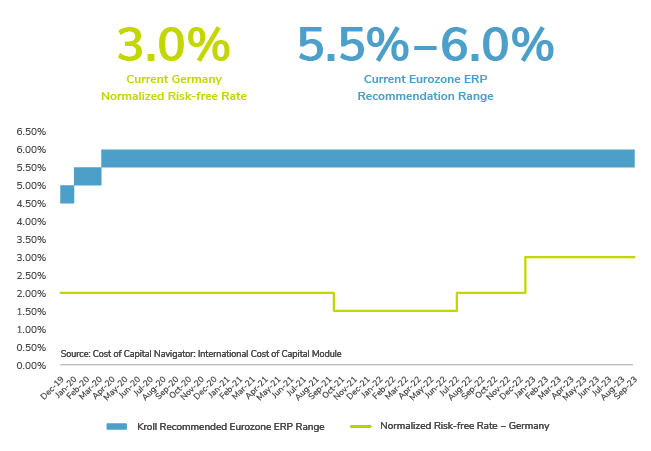

Duff & Phelps (Rebranded as Kroll) has published its recommended Eurozone ERP and corresponding risk-free rate since 2019. Download a table summarizing these recommendations over the period December 2019 – present.

Historical Recommendations

- Kroll Cost of Capital Recommendations and Potential Upcoming Changes – February 8, 2024 Update

- Kroll Recommended Eurozone ERP is being reaffirmed in the range of 5.5% to 6.0% until further notice

- Impact of High Inflation and Market Volatility on Cost of Capital Assumptions, Effective October 18, 2022

- Normalized Risk-Free Rates for Global Economies have Increased, Effective May 17, 2022

- Impact of the Russia-Ukraine Conflict on Cost of Capital Assumptions

- Brexit: The Impact on Cost of Capital