Kroll analyzed global data from 200 senior risk professionals in January and August 2021. More specifically, these executives were asked how they viewed the importance of Environmental, Social, Governance (ESG) standards and programs in relation to ABC programs. The change in sentiment from the first half of the year to the second revealed changes in the inclusion of ESG in ABC programs as well as the most important and challenging factors when implementing the ESG into ABC programs.

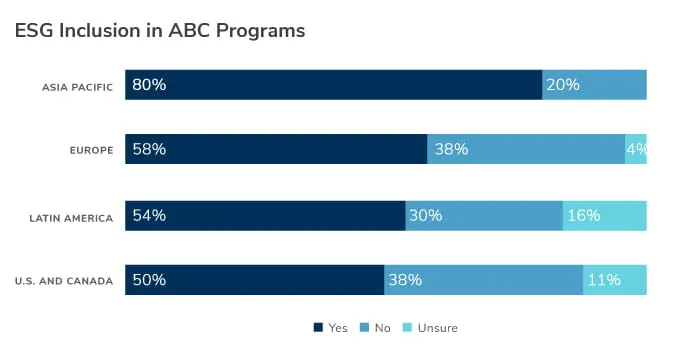

Survey respondents who stated that ESG is currently part of their anti-bribery and corruption program increased six percentage points from 54% to 60% from the earlier half of the year. A detailed breakdown of the responses, however, shows disparity between respondents from Asia Pacific, Europe, Latin America, and the U.S. and Canada. Asia Pacific and the U.S. and Canada experienced the largest increases in inclusion with a 16% and 14% jump, respectively. In comparison, Europe’s respondents including ESG in their ABC program increased at a slower pace by 6 percentage points from 52% to 58% between the first and the second instance of the survey. The outlier is Latin America where 54% of respondents indicated that ESG is currently part of their anti-bribery and corruption program, an 8% drop from the survey earlier in the year. Variations in responses may be explained by regional factors and the differences in relevant regulatory and compliance landscapes. With this uptick in the U.S. and Canada, ESG in now included in 50% or more of ABC programs across the four regions’ respondents surveyed.

Survey respondents who stated that ESG is currently part of their anti-bribery and corruption program increased six percentage points from 54% to 60% from the earlier half of the year. A detailed breakdown of the responses, however, shows disparity between respondents from Asia Pacific, Europe, Latin America, and the U.S. and Canada. Asia Pacific and the U.S. and Canada experienced the largest increases in inclusion with a 16% and 14% jump, respectively. In comparison, Europe’s respondents including ESG in their ABC program increased at a slower pace by 6 percentage points from 52% to 58% between the first and the second instance of the survey. The outlier is Latin America where 54% of respondents indicated that ESG is currently part of their anti-bribery and corruption program, an 8% drop from the survey earlier in the year. Variations in responses may be explained by regional factors and the differences in relevant regulatory and compliance landscapes. With this uptick in the U.S. and Canada, ESG in now included in 50% or more of ABC programs across the four regions’ respondents surveyed.

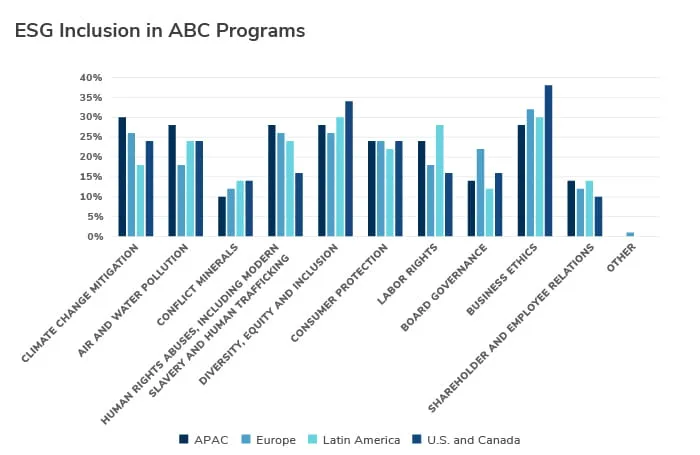

Multiple studies conducted since 2019 by organizations like the World Economic Forum and the Harvard Business Review link both gender and ethnic diversity to improved organizational performance, highlighting innovation in particular.1,2,3 A 2020 World Economic Forum report suggests that companies with diverse employees have up to 20% higher rates of innovation and 19% higher revenues.4 Our survey results indicate that business ethics, and diversity, equity and inclusion (DEI) were identified as the most common aspects implemented into ESG programs, with DEI ranked the second most commonly incorporated in three out of four regions surveyed – the U.S. and Canada (34% ), Latin America (30%) and Europe (26%).

Conversely, failure to operate intentionally around DEI issues, whether on the level of internal policies or public communications on broader sociocultural issues, can translate into a clear reputational risk for businesses. Media coverage and consumer perceptions aside, a lack of thoughtful and committed DEI initiatives has been linked to labor concerns – ranging from talent attrition to high-profile discrimination lawsuits.5

DEI was, however, not the most important aspect in ESG programs for the respondents from Asia Pacific, according to our 2021 ABC survey. Climate change mitigation was most commonly selected by respondents in Asia Pacific (30%), followed by air and water pollution, human rights and abuses, DEI, and business ethics (28% each). The results reflect the regional response to global pressure on reducing emissions, by which many Asia Pacific countries are affected as their economies are developing and rely heavily on manufacturing and agricultural activities. This is also a regional security concern, as Asia Pacific is usually among the top two regions most affected by climate change in terms of weather extremes and community displacement that result in supply chain disruptions and scarcity, causing local tensions and higher security risks. The close difference in selection (30% compared to 28%) also shows that respondents understand the importance of DEI and business ethics.

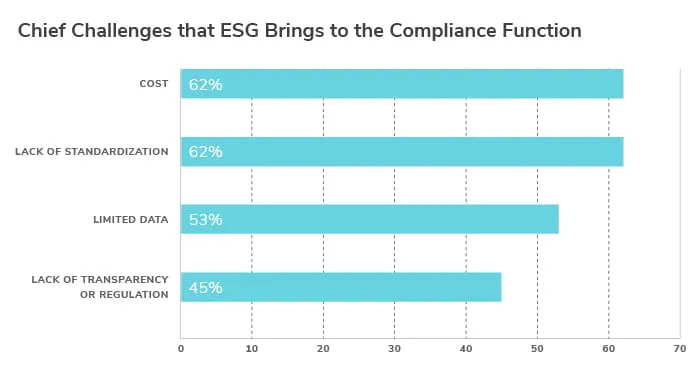

While the benefits of implementing elements of ESG into ABC and compliance programs is widely touted in industry publications, the challenges facing compliance departments in monitoring and complying with these standards may receive less attention. In our survey, 62% of respondents indicated that the cost of ESG program implementation and the lack of standardization across jurisdictions are the chief challenges faced – and for good reason. While the European Union has guidance like the Sustainable Finance Disclosure Regulation (SFDR) to ensure investment managers and financial market participants provide adequate disclosure of account sustainability and ESG risk factors to stakeholders, countries like the UK and the U.S. have yet to implement disclosure or regulating standards.6 This is not to say ESG factors and their impact on stakeholders are completely unregulated in the UK and the U.S. Both countries govern various aspects of ESG, including corporate governance (e.g. the UK Corporate Governance Code 2018), environmental (e.g. the US Environmental Protection Agency’s regulations and the UK Climate Change Act 2008), and social (the UK Modern Slavery Act 2015 and the U.S. Occupational Safety and Health Administration).7,8 However, many corporate leaders, not just the respondents to our survey, have called for regulatory bodies like the SEC to create standards for sustainability and diversity metric disclosures. Fortunately, both the UK and the U.S. have expressed an intention to adopt certain disclosure standards for climate-related financial information and to police misleading information given about ESG investments.9

Our 2021 ABC survey results also reported that cost of implementing ESG programs is identified among the top three enhanced due diligence challenges. As Commissioner Elad L. Roisman said in the ESG Board Forum in 2021, any new disclosure requirements, including (but not limited to) ESG, would generate costs for companies to obtain and present information, as well as the cost of increased liability for making such disclosures, and the cost would be proportionally higher for relatively smaller companies that have limited resources and/or in the growing stage.10 While there are not any statistics on the cost to implement ESG into compliance, a 2019 report by Bank of America found that controversies related to accounting scandals, data breaches, sexual harassment cases and other ESG issues resulted in over USD 500 billion loss in market value for unspecified companies in the S&P 500 index.11 With the increasing interests in ESG disclosures of regulators, including the U.S. SEC’s creation of a Climate and ESG Task Force in its Division of Enforcement and the release of the EU’s Sustainable Finance Disclosure Regulation, both in March 2021, the costs for non-compliance of ESG will likely increase.

While our survey results show an increase in inclusion of ESG in ABC programs, there is still a long way to go in terms of implementation, managing costs and measuring success due to a lack of benchmarking. The good news is, with ESG set as a high priority for regulators and executives alike, ESG disclosure regulations are likely to be standardized in the future across many countries and the costs associated with implementing these standards is not as daunting as some may think. In fact, the cost of not considering ESG factors in ABC programs may be even greater.

Sources

1. https://www.weforum.org/agenda/2019/08/3-reasons-why-business-leaders-cant-afford-to-ignore-diversity/

2. https://www.weforum.org/agenda/2019/04/business-case-for-diversity-in-the-workplace

3. https://hbr.org/2020/11/getting-serious-about-diversity-enough-already-with-the-business-case

4. https://www.weforum.org/reports/diversity-equity-and-inclusion-4-0-a-toolkit-for-leaders-to-accelerate-social-progress-in-the-future-of-work

5. https://hbr.org/2016/07/why-diversity-programs-fail

6. https://www.jdsupra.com/legalnews/the-eu-s-increasing-esg-regulation-and-7966413/

7. https://www.diligent.com/en-gb/blog/esg-regulations/

8. https://www.sec.gov/news/speech/can-the-sec-make-esg-rules-that-are-sustainable

9. https://www.jdsupra.com/legalnews/the-eu-s-increasing-esg-regulation-and-7966413/

10. https://www.sec.gov/news/speech/roisman-esg-2021-06-03

11. https://www.ft.com/content/3f1d44d9-094f-4700-989f-616e27c89599